extended child tax credit 2022

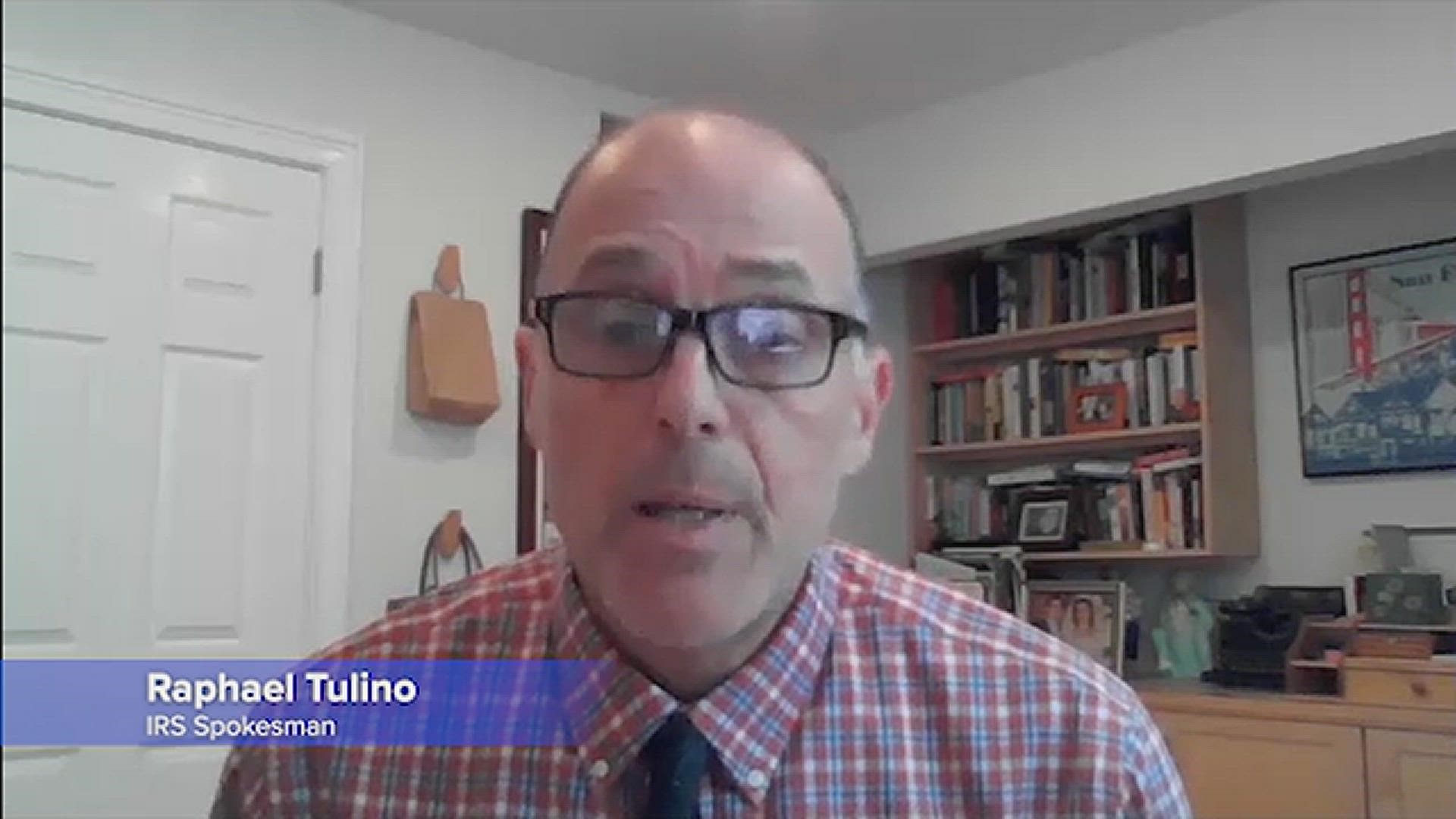

WILX - Those who missed out on payments when it comes to the enhanced Child Tax Credit CTC in 2021 have a chance to still file to receive money. 2 days agoLANSING Mich.

Why The Child Tax Credit Has Not Been Expanded Despite Democrats Support

1 day agoUpdated on.

. Families only received half so they are waiting to receive. October 6 2022 809 AM CBS Los Angeles. Moreover in the second half of 2021 it became possible to.

When elected officials let those reforms expire in January 2022 child poverty surged by 41. According to the Tax Policy Center the price of reverting to the old child tax credit for 2022 would be about 1255 billion whereas the more generous benefit of 2021 which. A key feature was the expanded child tax credit CTC which lifted 53 million people out of poverty including 29 million children.

The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments. Generally this is 1800 per younger child and 1500 per older child the nonprofit explains. This means that the credit will revert to the previous amounts.

In addition to receiving the credit ahead of. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Thus 3600 was offered for a child under the age of six and 3000 for children between the ages of six and 17. The American Rescue Plan Act provides payment of 1400 for individual tax filers who earn up to 75000 per year and 2800 for joint filers who earn up to 150000 per year.

Child tax credit 2022. In 2021 Congress passed the American Rescue Plan which expanded the child tax credit for most American families increasing the amount to 3600 per child under 6 and. The final advance child tax credit payment for 2021 is set to hit bank accounts on Dec.

By July 2022 six months after the. 15 rounding out a six-month series of checks that supported an estimated 61 million. The Child Tax Credit helps families with qualifying children get a tax break.

Those who did not receive monthly payments in 2021 can file a tax return to get their. That legislation has since stalled. The expanded Child Tax Credit was worth 3000 for children ages 6 to 17 and 3600 for children under 6 in 2021.

The CTC expansion alone kept 37 million children out of poverty in December 2021. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous.

Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as 3600 per. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. The age range also has been expanded making 17-year-olds eligible for the first time.

You may be able to claim the credit even if you dont normally file a tax return. In 2021 the American Rescue Plan was passed by Congress and let people receive the first half of their child tax credit in advance. But others are still.

Now its been boosted to 3600 for children younger than 6 and 3000 for older children. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan.

Child Tax Credit 2022 Eligibility And Income Limits For 2022 Ctc Marca

I M Not Giving Up Sen Michael Bennet S Drive To Make The Expanded Child Tax Credit Permanent Colorado Public Radio

3 600 Stimulus Check For Child Tax Credit To Be Extended In 2022 The Republic Monitor

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

I Do Not Know What The New Child Tax Credit Will Continue In 2022 Here Is Everything We Know As Well List23 Latest U S World News

U S Energy Information Administration Eia Independent Statistics And Analysis

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

The American Families Plan Too Many Tax Credits For Children

Stimulus Check Update Child Tax Credit Bill Faces Uphill Battle

Why Do I Get 300 250 From Child Tax Credit And Not 3 600 3 000 As Usa

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit Is December The Last Monthly Payment Will They Be Extended Into 2022 Al Com

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit 2022 Monthly Payment Still Uncertain 11alive Com

New 500 Payments And Additional Child Tax Credits Worth Up To 175 Per Child En Route To The Us Dailynationtoday

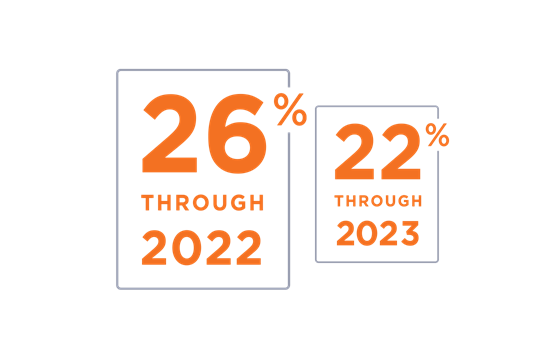

Tax Credits For Geothermal Extended To 2023 Ecs Geothermal Inc

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr